Gratuity In Uae

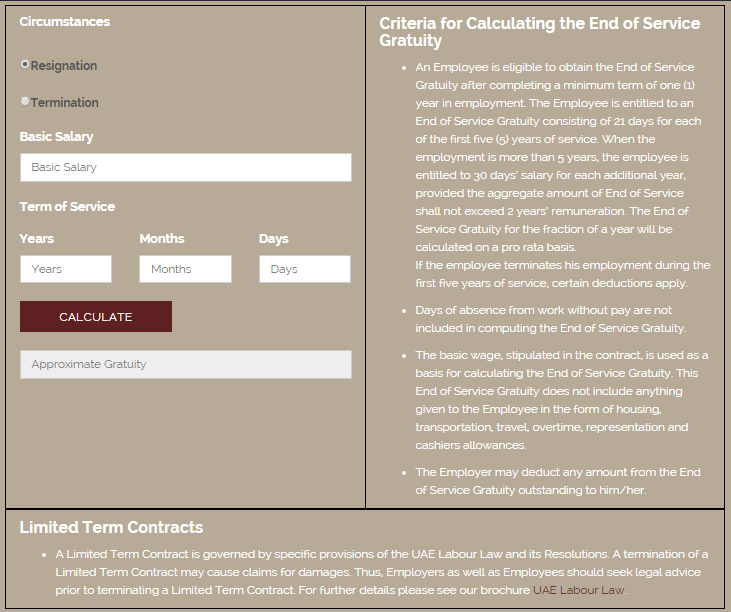

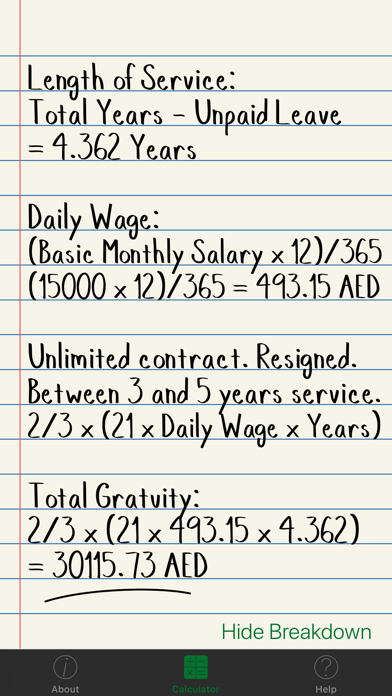

At the time of calculating gratuity the type of your contract with the company is kept in notice.

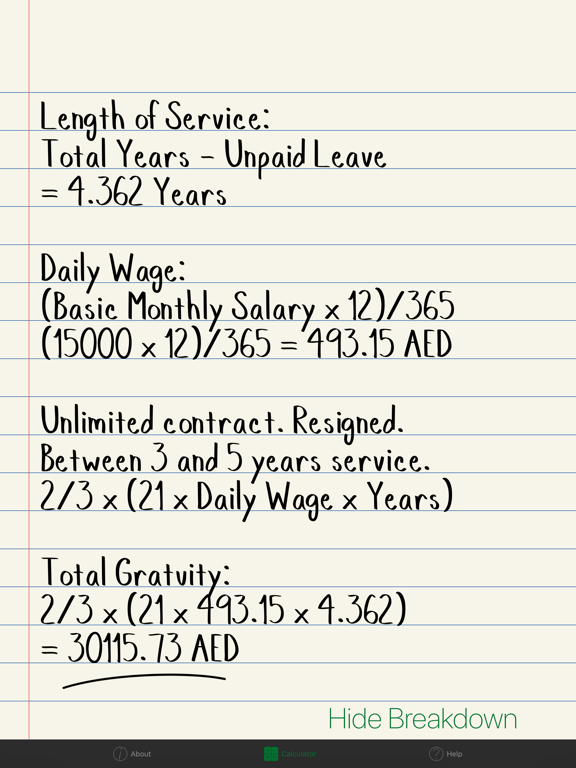

Gratuity in uae. 5 or more years of service. Terminated or leaving the uae for good. 1 to 5 years of service gratuity basic salary x 21 days x service years 30. Apart from this unfair act from employer is there any other way where employees lose rights to the end of service gratuity.

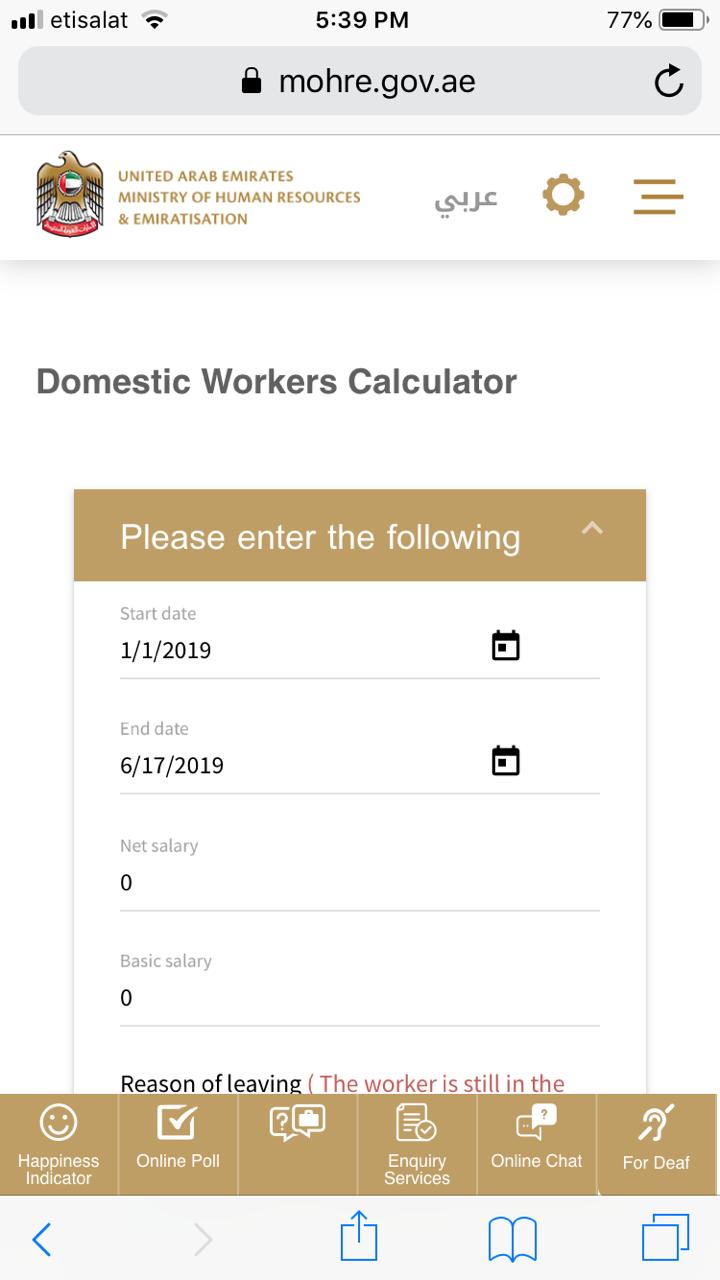

5 or more years of service gratuity basic salary x 21 days x service years 30. Will not be considered for calculating gratuity. After one year of service if a person resigns or the company ends the contract with him her the company employer will pay the gratuity to the employee. Dda has prepared an electronic form of gratuity calculator for sample calculation basis to licensees and their employees in respect to their employment matters.

Reason for termination of contract. Between 1 year and 5 years of service employee is entitled to full gratuity pay based on. 3 to 5 years of service gratuity basic salary x 14 days x service years 30. Refer article 132 and 134 of uae labour law.

The employee is entitled to an end of service gratuity consisting of 21 days for each of the first five 5 years of service. A person can qualify for gratuity in uae if he she completes their one year of continuous job without breaking any law. There is slightly different formula for gratuity calculation in uae for a person with limited contract and a person with. Gratuity basic salary x 7 days x service years 30.

They are meant to serve merely as guidance and consequently have no legal merit. The gratuity is calculated on the basic salary in the last drawn wages. Your total gratuity depends on the following factors. The information and details contained herein are based on the minimum terms and conditions prescribed in the uae labour law and any outcome resulting from the use of the gratuity calculator should not be construed as final and binding.

Other allowances such as housing conveyance overtime pay education allowance etc. As per the uae labour law all employees who have finished a full term of their employment contract are entitled to receive gratuity or end of service benefit. The gratuity calculation uae is the sum of money paid by an employer to the employee for the service rendered in the company. Total number of years served in the company.

When the employment is more than 5 years the employee is entitled to 30 days salary for each additional year provided the aggregate amount of end of service shall not exceed 2 years remuneration. Leaving work before completing one 1 year of service means that you are not entitled to any gratuity pay.